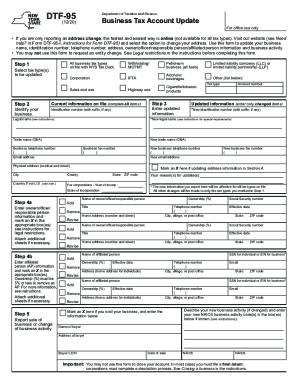

NY DTF DTF-95 2022-2024 free printable template

Show details

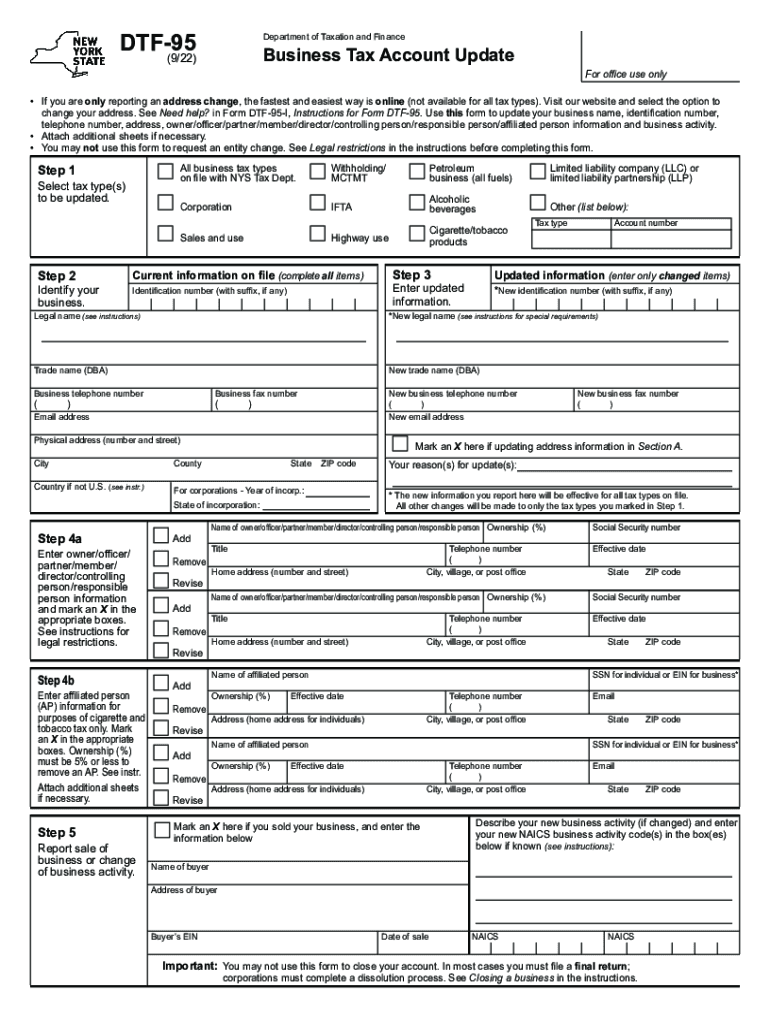

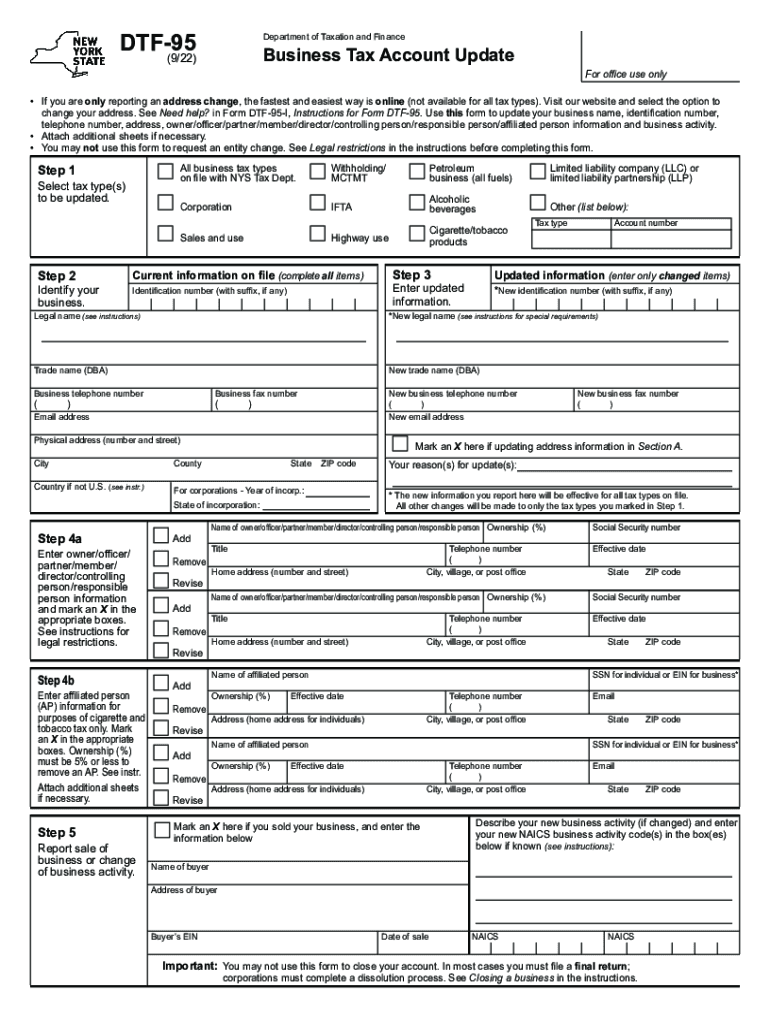

Visit our Web site see Need help in Form DTF-95-I Instructions for Form DTF-95 and select the option to change your address. Note If you wish to change the address for more than one tax type and the address is different for each tax type you must either attach another Form DTF-95 or Form DTF-96 for each additional tax type or using the same format create and attach a separate listing that contains all the address information indicates the tax type s for that address and your identification...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ny form dtf tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ny form dtf tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ny form dtf tax online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form dtf 95. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

NY DTF DTF-95 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ny form dtf tax

How to fill out dtf 95:

01

Read the instructions carefully to understand the purpose and requirements of dtf 95.

02

Start by providing your personal information, such as name, address, and contact details, in the designated sections.

03

Fill in any requested identification numbers, such as Social Security or Tax Identification numbers.

04

Follow the prompts to report your income, deductions, and credits accurately. This may include providing details about employment, investments, or other sources of income.

05

Review the form for completeness and accuracy before submitting it.

Who needs dtf 95:

01

Individuals who are required to file their state income taxes.

02

Anyone who has earned income in the state that requires reporting.

03

Individuals who have received forms W-2, 1099, or other income statements for the state.

Video instructions and help with filling out and completing ny form dtf tax

Instructions and Help about nys dtf 17 form

Fill nys form dtf : Try Risk Free

People Also Ask about ny form dtf tax

Where do I send my DTF 96?

What is a DTF 978 form?

Where do I send my NY state tax return?

What is a DTF 96?

Where do I file DTF 95?

Do I have to file NY state tax return for nonresident?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out dtf 95?

DTF-95 is a New York State Department of Taxation and Finance form used to file a tax return for businesses that are registered with the New York State Department of Taxation and Finance.

In order to fill out DTF-95, you will need to provide the following information:

1. Business name, address, and taxpayer identification number (TIN).

2. Type of return being filed.

3. Filing period (month and year).

4. Total tax due (if any).

5. Detailed list of gross receipts, income, and expenses.

6. Payment information (if any).

7. Signature of taxpayer.

It is important to make sure that all information provided is accurate and complete, as this will affect the amount of tax due and the accuracy of your return.

What is dtf 95?

DTF 95 stands for "Down to F*** 1995", which is a slang phrase that originated on social media and is used to indicate that someone is willing or eager to engage in sexual activity. The "1995" in the phrase is often used playfully to suggest that the person is expressing a strong desire for sexual activity, as if they were 25 years younger.

Who is required to file dtf 95?

DTF-95 is a tax form used in the state of New York, specifically for businesses subject to the Metropolitan Commuter Transportation Mobility Tax (MCTMT).

The businesses required to file Form DTF-95 are those that meet the following criteria:

1. Employers located in the Metropolitan Commuter Transportation District (MCTD) with payroll expense exceeding the threshold amount set by the New York State Department of Taxation and Finance.

2. Employers located outside the MCTD who have employees who perform services within the MCTD and have payroll expenses exceeding the threshold amount.

The form is used to report and pay the MCTMT, which is a tax imposed on employers based on their payroll expenses.

What information must be reported on dtf 95?

DTF-95 is a tax form used in the state of New York, specifically for reporting individual income tax liability. The information that must be reported on DTF-95 includes:

1. Personal information: This includes your name, address, social security number, and filing status (such as single, married filing jointly, or head of household).

2. Income: You need to report all your sources of income, including wages, salary, tips, interest, dividends, rental income, self-employment income, and any other sources of income.

3. Deductions and credits: You can claim various deductions and credits to reduce your taxable income. These may include deductions for mortgage interest, student loan interest, state and local taxes paid, charitable contributions, and credits for child and dependent care expenses, education expenses, and energy-efficient home improvements.

4. Tax withholding and estimated payments: You need to provide information about any tax withheld from your income throughout the year, such as federal and state withholding, as well as any estimated tax payments you made to meet your tax liability.

5. Other information: If applicable, you may need to report additional information, such as non-resident or part-year resident information, tax treaty details, and any other relevant information for your tax situation.

It is important to carefully review the specific instructions provided by the New York State Department of Taxation and Finance for accurate reporting on DTF-95, as requirements may vary depending on individual circumstances.

What is the penalty for the late filing of dtf 95?

The DTF-95 form typically refers to the Annual Report of an Authorized Corporation filing in New York State. The late filing penalty for the DTF-95 form is $300. However, it's important to note that penalties and fees may vary, and consulting with the New York State Department of Taxation and Finance or a tax professional would provide the most accurate and up-to-date information.

How can I edit ny form dtf tax from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your form dtf 95 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for the dtf 95 instructions in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your nys business tax in seconds.

How do I complete dtf 95 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your dtf 95 form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your ny form dtf tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dtf 95 Instructions is not the form you're looking for?Search for another form here.

Keywords relevant to nys form dtf 95

Related to form dtf 95 new york

If you believe that this page should be taken down, please follow our DMCA take down process

here

.